UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement | |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

| Definitive Additional Materials | |

| Soliciting Material | |

Ritter Pharmaceuticals,Qualigen Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the Appropriate Box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials | |||

| ☐ | Fee computed on table | |||

December 1, 2017June 2, 2023

Dear Stockholder,Stockholder:

You are cordially invited to attend a Specialthe 2023 Annual Meeting of Stockholders of Qualigen Therapeutics, Inc. (“Qualigen” or the “Company”) on Thursday, July 13, 2023, at 10:00 a.m., Pacific Daylight Time, at 2042 Corte Del Nogal, Carlsbad, California 92011.

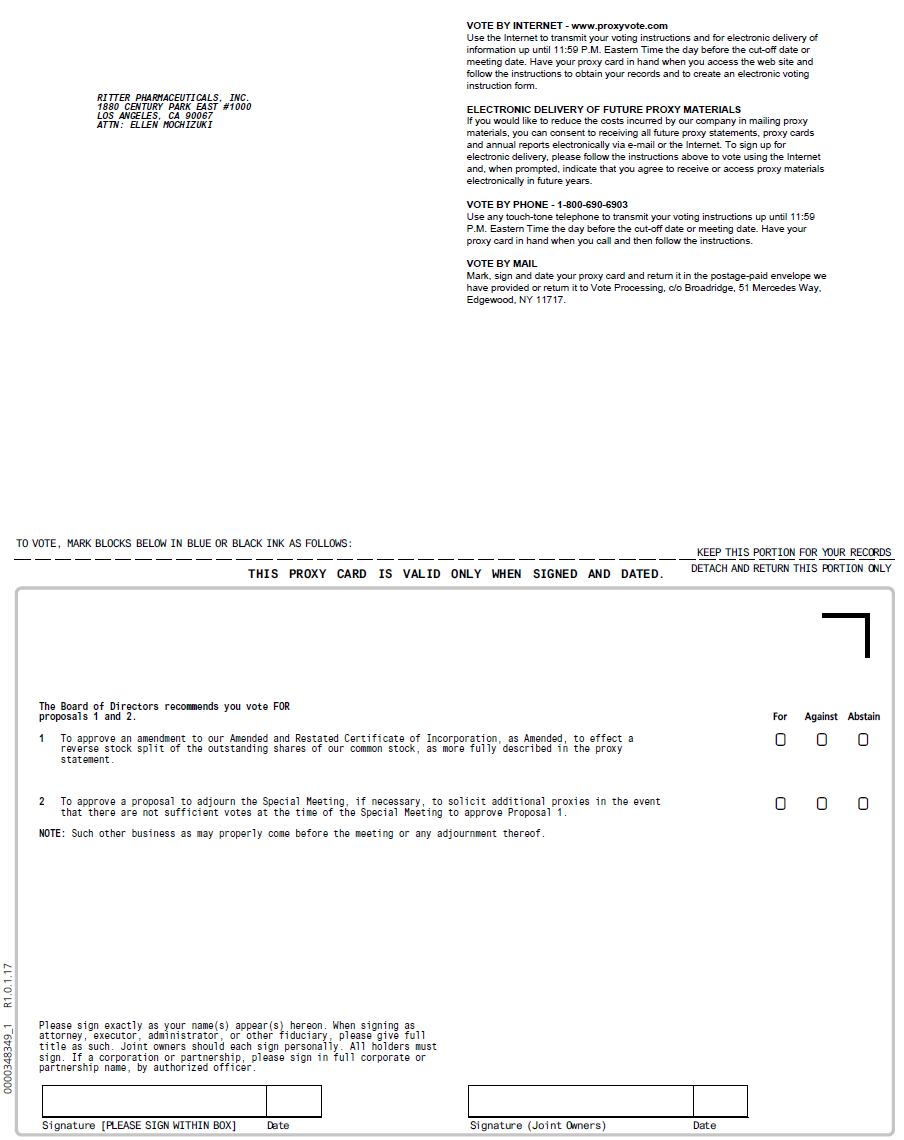

The attached proxy statement describes the business to be conducted at the 2023 Annual Meeting of Stockholders (the “Special“Annual Meeting”) of Ritter Pharmaceuticals, Inc. (“Ritter” or the “Company”) on Wednesday, December 20, 2017, at 9:00 A.M. Pacific Time (PT), at the offices of Reed Smith LLP, 1901 Avenue of the Stars, Suite 700, Los Angeles, CA 90067-6078 for the following purposes:

These items of business are more fully described in the proxy statement. In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

The board of directors of Ritter has determined that the reverse stock split is in the best interests of Ritter and its stockholders. For the reasons set forth in the proxy statement, the board of directors unanimously recommends a vote “FOR” each matter to be considered.

We hope you can join us at the SpecialAnnual Meeting. As a stockholder, your participation in the affairs of RitterQualigen is important, regardless of the number of shares you hold. Therefore, whether or not you are able to personally attend the Annual Meeting, please vote your shares as soon as possible by following the instructioninstructions provided in the enclosed proxy card or voting instruction card if you hold your shares through a bank, broker or other financial intermediary, by following the instructions provided by the financial intermediary. If you decide to attend the Special Meeting, you will be able to vote in person even if you have previously voted.

Our Notice of Special2023 Annual Meeting of Stockholders, and proxy statement for the SpecialAnnual Meeting (including proxy card)and 2022 Annual Report on Form 10-K are available atwww.proxyvote.com. We hope you find them informative reading.

On behalf of the boardBoard of directors,Directors, we would like to express our appreciation for your continued interest in the affairs of Ritter Pharmaceuticals,Qualigen Therapeutics, Inc.

| Sincerely yours, | ||

| ||

| /s/ Michael S. Poirier | ||

| Michael S. Poirier | ||

| Chairman and Chief Executive Officer |

| |

1880 Century Park East, #1000, Los Angeles, CA 90067

TEL: (310) 203-1000

http:// www.ritterpharmaceuticals.com

RITTER PHARMACEUTICALS,QUALIGEN THERAPEUTICS, INC.1880 Century Park East, #1000

Los Angeles, CA 90067

NOTICE OF SPECIAL2023 ANNUAL MEETING OF STOCKHOLDERS

Please take notice of the following information regarding the 2023 Annual Meeting of Stockholders of Qualigen Therapeutics, Inc. (the “Annual Meeting”):

| TIME | |||

| PLACE | |||

| ITEMS OF BUSINESS | 1. | To | |

| 2. | To | ||

| 3. | To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance to Alpha Capital Anstalt (“Alpha”) of more than 20% of the Company’s issued and outstanding common stock pursuant to the terms and conditions of (a) the 8% Senior Convertible Debenture Due December 22, 2025 in favor of Alpha, and (b) the Company’s common stock purchase warrant dated December 22, 2022 issued to Alpha; and | ||

| 4. | To approve, on a non-binding, advisory basis, the compensation of our named executive officers. | ||

RECORD DATE | You are entitled to vote at the | ||

| ANNUAL REPORT | Our 2022 Annual Report on Form 10-K is a part of our proxy materials being made available to you. | ||

PursuantWhether or not you plan to rules promulgatedattend the Annual Meeting, please vote your shares as soon as possible by telephone, via the U.S. SecuritiesInternet or by completing, dating, signing and Exchange Commission, we have elected to provide access to our proxy materials by sending you this full set of proxy materials, includingreturning a proxy card to ensure your shares are voted, or, if you hold your shares in street name, by following the instructions provided by your bank, broker or other financial intermediary. Submitting your proxy now will not prevent you from voting instruction card,your shares at the Annual Meeting if you desire to do so, as your proxy is revocable and notifying you ofvoting your shares at the availability of our proxy materials on the Internet. The proxy materials are available atwww.proxyvote.com.Annual Meeting will automatically revoke any prior vote by proxy.

| By Order of the Board of Directors | |

| |

| /s/ Michael S. Poirier | |

| Michael S. Poirier | |

December 1, 2017June 2, 2023

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting

to be Held on Wednesday, December 20, 2017

This Notice of Special Meeting of Stockholders and the Proxy Statement (including the proxy card) are available at:

www.proxyvote.com

This website does not use “cookies,” to track the identity of anyone accessing the

website to view the proxy materials, or gather any personal information.

RITTER PHARMACEUTICALS, INC.Qualigen Therapeutics, Inc.

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERSProxy Statement for 2023 Annual Meeting of Stockholders

RITTER PHARMACEUTICALS, INC.

1880 Century Park East, #1000

Los Angeles, CA 90067

PROXY STATEMENT FOR THE SPECIAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND THE SPECIAL2023 ANNUAL MEETING OF STOCKHOLDERS

| Q: | What proposals will be voted on at the |

| A: | There are |

| ● | ||

| ● | The ratification of the appointment of Baker Tilly US, LLP as Qualigen’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal 2); |

| -1- |

| ● | The approval, for purposes of complying with Nasdaq Listing Rule 5635(d), of the issuance to Alpha Capital Anstalt (“Alpha”) of more than 20% of the Company’s issued and outstanding common stock | |

| ● |

The stockholders will also be asked to consider and vote upon any other business properly brought before the Annual Meeting.

| Q: | What are the |

| A: | The |

| ● | FORthe | |

| ● | FORthe |

| ● | FOR the Alpha Stock Issuance Proposal (Proposal 3); and | |

| ● | FOR the approval, on a non-binding, advisory basis, of the compensation of our named executive officers (Proposal 4). |

| 1. | those held directly in your name as thestockholder of record; and | |

| 2. | those held for you as thebeneficial ownerthrough a bank, broker or other financial intermediary at the close of business on the Record Date. |

Each share of common stock is entitled to one vote. As of the Record Date, there were 5,052,463 shares of our common stock outstanding.

| -2- |

If you are the beneficial owner of shares held in street name, you may instruct your bank, broker or other financial intermediary to vote your shares by following the instructions provided by your bank, broker or other financial intermediary. Most intermediaries offer voting by mail, by telephone and on the Internet.

| -3- | |

| If you specify a voting choice, the shares will be voted in accordance with that choice. If you vote your shares by proxy, but do not indicate your voting preferences as to one or more of the proposals, the persons named as proxies by our |

| -4- |

Additional Q&A information regarding the SpecialAnnual Meeting and stockholder proposals may be found on page 17.32.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

SECURITY The Board of Directors

Our Board of Directors currently consists of seven members. Our directors hold office for one year or until their respective successors have been duly elected or until their death, resignation or removal. Our amended and restated bylaws provide that the authorized number of directors comprising our Board of Directors will be fixed, from time to time, by a majority of the total number of directors.

As previously described in a Current Report on Form 8-K filed with the SEC on May 19, 2023, Amy Broidrick, our Chief Strategy and Operating Officer and a director of the Company, provided her notice of resignation to the Company on May 16, 2023, which will become effective June 16, 2023 (the “Effective Date”). As of the Effective Date, Ms. Broidrick will resign from all officer and director positions with the Company and its subsidiaries. In connection with Ms. Broidrick’s resignation, our Board of Directors intends to reduce its size from seven members to six members as of the Effective Time.

Biographical information with respect to our director nominees is provided below. There are no family relationships among any of our directors or executive officers. There is no arrangement or understanding between any director and any other person pursuant to which the director was selected.

| Name | Position with the Company | Age | Director Since | |||

| Michael Poirier | Chairman and Chief Executive Officer | 67 | 2020 | |||

| Richard David | Director | 63 | 2020 | |||

| Sidney Emery, Jr. | Director | 77 | 2020 | |||

| Matthew Korenberg | Director | 48 | 2020 | |||

| Kurt Kruger | Director | 67 | 2020 | |||

| Ira Ritter | Director | 74 | 2008 |

Michael S. Poirier. Mr. Poirier founded the Qualigen business in 1996 and is its Chairman and Chief Executive Officer. Before founding Qualigen, Mr. Poirier had relevant operating, marketing and sales positions with Ashirus Technologies, Inc., EnSys, Inc., Sanofi Pasteur and Abbott Laboratories, Inc. Before working at Abbott, Mr. Poirier served as an officer in the United States Navy, assigned to the US Atlantic Fleet. Mr. Poirier holds a B.A. from Providence College and attended the University of Zürich, Switzerland, School of Law.

Mr. Poirier’s commitment to our strategic goals, his long experience leading our company and his deep knowledge of its technologies and business contributed to our Board of Directors’ conclusion that he should serve as a director of our company.

Richard A. David, MD FACS. Dr. David serves as Chief Medical Officer for the Los Angeles Division of Genesis Healthcare Partners, the largest urology group in Southern California. He also serves as medical director for Genesis’ Advanced Prostate Cancer Center of Excellence. In addition, Dr. David serves as Clinical Professor of Urology for the David Geffen School of Medicine at UCLA. Dr. David obtained his undergraduate education at Stanford University and his medical degree at Thomas Jefferson University in Philadelphia. He also holds a Master’s degree in Medical Management (MMM) from the Marshall School of Business at the University of Southern California. He trained in general surgery and completed his urology residency at UCLA Medical Center in Los Angeles. Dr. David is a fellow of the American College of Surgeons.

Dr. David’s experience as an executive of a large healthcare organization, including his background as a medical doctor, contributed to our Board of Directors’ conclusion that he should serve as a director of our company.

Sidney W. Emery, Jr. Mr. Emery acquired Supply Chain Services in 2010 and, as its Chief Executive Officer, grew it into a premier provider of automatic identification and data capture and factory automation solutions before selling the business to Sole Source Capital LLC in May 2020. Before Supply Chain Services, he served as Chairman and Chief Executive Officer of MTS Systems Corporation (Nasdaq-GS: MTSC), a leading global supplier of mechanical testing systems and high-performance industrial position sensors. Mr. Emery served on the Board of Directors of Allete, Inc. (NYSE: ALE), a Minnesota-based utilities and energy company, from 2006 to 2018. Mr. Emery chairs the University of St. Thomas School of Engineering Board of Governors. Mr. Emery holds a PhD in Industrial Engineering from Stanford University and a B.S. in Engineering from the US Naval Academy. He served for 10 years in the US Navy (including on gunboats in Vietnam).

| -6- |

Mr. Emery’s extensive board service with and executive leadership of major companies contributed to our Board of Directors’ conclusion that he should serve as a director of our company.

Matthew E. Korenberg. Mr. Korenberg has served as President and Chief Operating Officer of Ligand Pharmaceuticals Incorporated (Nasdaq: LGND), a biopharmaceutical company focused on developing or acquiring technologies that help pharmaceutical companies discover and develop medicines, since November 2022, and before that as Executive Vice President, Finance and Chief Financial Officer of Ligand Pharmaceuticals Incorporated since August 2015. Before joining Ligand, commencing in September 2013, Mr. Korenberg was the founder, Chief Executive Officer and a director of NeuroCircuit Therapeutics, a company focused on developing drugs to treat genetic disorders of the brain with an initial focus on Down syndrome. Before founding NeuroCircuit Therapeutics, Mr. Korenberg was a Managing Director and member of the healthcare investment banking team at Goldman Sachs from July 1999 through August 2013. During his 14 year tenure at Goldman Sachs, Mr. Korenberg was focused on advising and financing companies in the biotechnology and pharmaceutical sectors and was based in New York, London and San Francisco. Before Goldman Sachs, Mr. Korenberg was a healthcare investment banker at Dillon, Read & Co. Inc. where he spent two years working with healthcare companies in the biotechnology and pharmaceutical sectors and industrial companies. Mr. Korenberg holds a B.B.A. in Finance and Accounting from the University of Michigan.

Mr. Korenberg’s financial and accounting expertise, his experience as chief financial officer of a large public biopharmaceutical company and his investment banking background contributed to our Board of Directors’ conclusion that he should serve as a director of our company.

Kurt H. Kruger. Mr. Kruger has enjoyed a 30-year career in medical technology. His deep involvement in the field has ranged from product design and development as a biomedical engineer to raising capital for, and following, publicly traded medical product companies as an equities research analyst. As a marketing manager at Guidant, now a part of Boston Scientific, he developed the launch plans for the first-ever implantable defibrillator. As a securities analyst he showed perspicuity leading Hambrecht & Quist in providing venture funds for, and then taking public, Ventritex, which was later acquired by St. Jude Medical. After Hambrecht & Quist, Mr. Kruger worked as an analyst for Montgomery Securities and Bank of America. Across 20 years of research work, Mr. Kruger has overseen the IPOs of over 30 medical products companies, including leadership of the Life Sciences banking effort for WR Hambrecht & Co. Mr. Kruger received a Sc.B. degree in Biomedical Engineering from Brown University; a Master’s degree in Bioengineering from the University of Michigan; and a business degree (S.M.) from the Sloan School at the Massachusetts Institute of Technology (MIT). He also completed the premedical post-baccalaureate program at Columbia University.

Mr. Kruger’s long experience in investment banking and securities analysis with a life sciences focus contributed to our Board of Directors’ conclusion that he should serve as a director of our company.

Ira E. Ritter. Mr. Ritter served as Co-Founder, Chief Strategic Officer and Executive Chairman of our predecessor, Ritter Pharmaceuticals, Inc., from its inception in 2004 through the formation of Ritter Pharmaceuticals, Inc. in 2008 and served in those positions with Ritter Pharmaceuticals, Inc. from 2008 until the May 22, 2020 reverse recapitalization transaction (the “Reverse Recapitalization Transaction”) in which Ritter Pharmaceuticals, Inc. changed its name to Qualigen Therapeutics, Inc. Mr. Ritter has extensive experience creating and building diverse business enterprises and since 1987 through Andela Corporation, of which he is the CEO, has provided corporate management, strategic planning and financial consulting for a wide range of market segments including; health product related national distribution and private label production, television and publishing. He assisted taking Ritter Pharmaceuticals, Inc. public on Nasdaq and Martin Lawrence Art Galleries public on the New York Stock Exchange. Since 2010, Mr. Ritter has also acted as a managing partner of Stonehenge Partners, LLC. Mr. Ritter has a long history of public service that includes appointments by three Governors to several State of California Commissions including eight years as Commissioner on the California Prison Industry Authority.

Mr. Ritter’s experience as an entrepreneur and chairman of a publicly traded development-phase therapeutics company contributed to our Board of Directors’ conclusion that he should serve as a director of our company. Mr. Ritter continued his service on our Board of Directors, by agreement in connection with the Reverse Recapitalization Transaction, as the designated legacy member from the pre-Reverse Recapitalization Transaction public-company board of directors.

Board of Directors Leadership Structure

Michael Poirier, our chief executive officer, also serves as chairman of the Board of Directors. Our Board of Directors has determined that having the same person fill both roles is appropriate at this time given the early stage of our business and that separating the roles could add inefficiencies without bringing meaningful advantages for our stockholders.

| -7- |

Under Nasdaq’s continued listing requirements, a majority of a listed company’s board of directors must be comprised of independent directors, subject to certain exceptions. In addition, Nasdaq’s continued listing requirements require that, subject to certain exceptions, each member of a listed company’s audit, compensation and governance and nominating committees must be independent. Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. Under Nasdaq’s continued listing requirements, a director will only qualify as an “independent director” if, in the opinion of that company’s Board of Directors, such person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Based upon information requested from and provided by each director concerning their background, employment and affiliations, including family relationships, our Board of Directors determined that, as of the date of this proxy statement, each of Messrs. David, Emery, Korenberg, Kruger and Ritter are independent under the applicable rules and regulations of Nasdaq. In making such determinations, the Board of Directors considered the relationships that each such non-employee director has with our company and all other facts and circumstances the Board of Directors deemed relevant in determining their independence.

Board of Directors’ Role in Risk Oversight

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including risks relating to product candidate development, technological uncertainty, dependence on third parties, uncertainty regarding patents and proprietary rights, comprehensive government regulations, having no therapeutics manufacturing experience, having no therapeutics marketing or sales capability or experience and dependence on key personnel, as more fully discussed under “Risk Factors” in our 2022 Annual Report. Management is responsible for the day-to-day management of risks we face, while our Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

Our Board of Directors is actively involved in oversight of risks that could affect us. This oversight is conducted primarily through committees of the Board of Directors, but the full Board of Directors has retained responsibility for general oversight of risks.

Committees of the Board of Directors

Our Board of Directors has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each committee operates under a charter. Copies of each committee’s charter are posted on the Investor Relations section of our website, which is located at www.qualigeninc.com.

Audit Committee. The current members of our Audit Committee are Mr. Kruger (Chair), Mr. Emery, and Mr. Korenberg, each of whom was determined by our Board of Directors to be independent under Rule 10A-3 under the Exchange Act and the continued listing requirements of Nasdaq, and to satisfy the other continued listing requirements of Nasdaq for audit committee membership. The Company has identified Matthew Korenberg as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of SEC Regulation S-K, and has determined that he has the requisite level of financial sophistication required by the continued listing requirements of Nasdaq; this identification does not constitute a determination that other members of the Audit Committee would not also be able to qualify as an “audit committee financial expert.”

Under the Audit Committee charter, our Audit Committee is responsible for the following actions, among others:

| ● | appointing and retaining the independent auditors to conduct the annual audit of our financial statements; | |

| ● | reviewing the proposed scope of and the results of the audit; | |

| ● | reviewing and pre-approving audit and non-audit fees and services; | |

| ● | reviewing and discussing with management and the independent auditors our financial reporting processes, internal control over financial reporting and disclosure controls and procedures; | |

| ● | reviewing, approving and overseeing transactions between us and our directors, officers and affiliates; | |

| ● | establishing procedures for complaints received by us regarding accounting matters or internal control over financial reporting; and | |

| ● | preparing the report of the Audit Committee that SEC rules require to be included in our annual meeting proxy statement. |

| -8- |

Compensation Committee. The current members of our Compensation Committee are Dr. David (Chair), Mr. Emery and Mr. Korenberg, each of whom was determined by our Board of Directors to be independent under the continued listing requirements of Nasdaq.

Under the Compensation Committee charter, our Compensation Committee is responsible for the following actions, among others:

| ● | determining and approving the compensation of our chief executive officer and our other executive officers, subject to review and ratification by the full Board of Directors; | |

| ● | administering our incentive compensation plans and equity-based plans; | |

| ● | reviewing, approving and recommending to the Board of Directors any employment agreements and any severance arrangements or plans; and | |

| ● | reviewing director compensation for board and board committee service at least once a year and recommending any changes to the Board of Directors. |

To determine executive compensation, the Compensation Committee, with input from the Chief Executive Officer and other members of senior management (who do not participate in the deliberations regarding their own compensation), reviews, at least annually, and makes recommendations to the Board of Directors as to appropriate compensation levels for each executive officer of the Company. The Compensation Committee considers all factors it deems relevant in setting executive compensation.

Under its charter, the Compensation Committee has the authority, in its sole discretion, to select, retain and obtain the advice of a compensation consultant as necessary to assist with the execution of its duties and responsibilities as set forth in its charter, but only after taking into account certain factors prescribed by Nasdaq bearing on the consultant’s independence. There is no requirement, however, that a compensation consultant be independent.

The Compensation Committee did not engage a compensation consultant for 2023, but did engage Radford (which is part of Aon Hewitt, a business unit of Aon plc) as its compensation consultant for 2022.

The Compensation Committee identified and selected Radford based on their reputation and experience consulting companies in the life sciences industry. In 2022, Radford assisted the Compensation Committee in:

| ● | reviewing and refining a peer group of companies for market assessment; | |

| ● | conducting a competitive compensation assessment (with recommendations) for compensation of the senior management team; and | |

| ● | conducting a competitive compensation assessment (with recommendations) for compensation of the Board of Directors; |

Nominating and Corporate Governance Committee. The current members of our Nominating and Corporate Governance Committee are Mr. Emery (Chair), Dr. David and Mr. Korenberg, each of whom was determined by our Board of Directors to be independent under the continued listing requirements of Nasdaq.

Under the Nominating and Corporate Governance Committee charter, our Nominating and Corporate Governance Committee is responsible for the following actions, among others:

| ● | identifying, screening and making recommendations to the Board of Directors regarding director nominees and Board of Directors committee composition; | |

| ● | overseeing our corporate governance practices and making recommendations to the Board of Directors regarding any changes to our corporate governance framework; and | |

| ● | overseeing the evaluation of our Board of Directors and its committees. |

| -9- |

Director Nominations

Director nominees are considered by our Nominating and Corporate Governance Committee on a case-by-case basis. A candidate for election to our Board of Directors must possess the ability to apply good business judgment and must be in a position to properly exercise his or her duties of loyalty and care in his or her representation of the interests of stockholders. The Nominating and Corporate Governance Committee will consider nominees identified by the Nominating and Corporate Governance Committee or the Board of Directors, by stockholders, or through other sources. When current directors are considered for nomination for reelection, the Nominating and Corporate Governance Committee will take into consideration their prior contributions and performance as well as the composition of our Board of Directors as a whole, including whether the Board of Directors reflects the appropriate balance of desired qualities. The Nominating and Corporate Governance Committee will make a preliminary assessment of each proposed nominee based upon the résumé and biographical information, an indication of the individual’s willingness to serve, and other relevant information. This information will be evaluated against the specific needs of the Company at that time. Based upon a preliminary assessment of the candidate(s), those who appear best suited to meet the needs of the Company may be invited to participate in a series of interviews, which are used as a further means of evaluating potential candidates. On the basis of information learned during this process, the Nominating and Corporate Governance Committee will determine which nominee(s) to submit for election. The Nominating and Corporate Governance Committee will use the same process for evaluating all nominees, regardless of the original source of the nomination.

It is our Nominating and Corporate Governance Committee’s responsibility to consider stockholders’ proposed nominees for election as directors that are nominated in accordance with our certificate of incorporation and our bylaws, and other applicable laws, including the rules and regulations of the SEC and any stock market on which our stock is listed for trading or quotation. Generally, such recommendations made by a stockholder entitled to notice of, and to vote at, the meeting at which such proposed nominee is to be considered are required to be written and received by the Secretary of the Company by no later than the close of business on the 90th day before the first anniversary of the preceding year’s annual meeting of stockholders, nor earlier than the close of business of the 120th day before the first anniversary of the preceding year’s annual meeting of stockholders. The notice must set forth any and all of the information required by the Company’s bylaws. In addition to satisfying the foregoing requirements under our bylaws, to comply with the SEC’s universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than the same deadline under the Company’s advance notice bylaws, as described above.

Board Diversity

Our Nominating and Corporate Governance Committee is responsible for determining the qualifications, qualities, skills, and other expertise required to be a director and is responsible for developing, and recommending to the Board of Directors for its approval, criteria to be considered in selecting nominees for director. In evaluating the suitability of individual candidates (both new candidates and current members), the Nominating and Corporate Governance Committee, in recommending candidates for election, and the Board of Directors, in approving (and, in the case of vacancies, appointing) such candidates, takes into account such criteria.

In our director nominations, we strive to not discriminate in favor of or against anyone on the basis of race, age, sex, gender, sexual orientation, religion, disability, ethnicity, or membership in or identification with underrepresented communities.

Set forth below is information concerning the gender and demographic background of each of our current directors, as self-identified and reported by each director. This information is being provided in accordance with Nasdaq’s board diversity rules.

| Board Diversity Matrix (As of June 2, 2023) | ||||||||

| Total Number of Directors: | 7 | |||||||

| Female | Male | Non-Binary | Did Not Disclose | |||||

| Part I: Gender Identity | ||||||||

| Directors | 1 | 4 | 2 | |||||

| Part II: Demographic Background | ||||||||

| African American or Black | ||||||||

| Alaskan Native or Native American | ||||||||

| Asian | ||||||||

| Hispanic or Latinx | 1 | |||||||

| Native Hawaiian or Pacific Islander | ||||||||

| White | 1 | 3 | ||||||

| Two or More Races or Ethnicities | ||||||||

| LGBTQ+ | ||||||||

| Did Not Disclose Demographic Background | 2 | |||||||

| -10- |

The Board of Directors held five meetings in 2022; the Audit Committee held four meetings in 2022; and the Compensation Committee held two meetings in 2022. The Nominating and Corporate Governance Committee did not meet in 2022. Each director who served as a director of the Company during 2022 participated in 75% or more of the meetings of the Board of Directors and of the committees on which he or she served during the year ended December 31, 2022 (during the period that such director served).

At each regular meeting of the Board of Directors, the independent directors meet in private without members of management.

We encourage all of our directors to attend our annual meeting of stockholders. Two directors attended our 2022 annual meeting of stockholders.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The code of business conduct and ethics is reviewed periodically and amended as necessary and is available on our website at www.qualigeninc.com. Any amendments to the code of business conduct and ethics, or any waivers of its requirements that apply to our principal executive officer, principal financial officer or principal accounting officer, will be disclosed on our website.

Stockholder Communications with the Board of Directors

The Board of Directors has not established a formal process for security holders to send communications to the Board of Directors and the Board of Directors has not deemed it necessary to establish such a process at this time. Historically, almost all communications that the Company receives from security holders are administrative in nature and are not directed to the Board of Directors. If the Company should receive a security holder communication directed to the Board of Directors, or to an individual director, said communication will be relayed to the Board of Directors or the individual director, as the case may be.

Certain Relationships and Related Party Transactions

Our Audit Committee is responsible for reviewing, approving and overseeing any transaction between the Company and its directors, director nominees, executive officers, greater than 5% beneficial owners, and each of their respective immediate family members, where the amount involved exceeds the lesser of (i) $120,000 and (ii) 1% of the average of our total assets at year-end for the prior two fiscal years. Since January 1, 2021, there have been no such transactions except as described below.

Transactions with Alpha Capital Anstalt

On May 26, 2022, the Company acquired 2,232,861 shares of Series A-1 Preferred Stock of NanoSynex, Ltd. (“NanoSynex”) from Alpha, a related party, in exchange for 350,000 reverse split adjusted shares of the Company’s common stock and a prefunded warrant to purchase 331,464 reverse split adjusted shares of the Company’s common stock at an exercise price of $0.001 per share. These warrants were subsequently exercised on September 13, 2022.

As a result of the transaction described above and our concurrent acquisition of 381,786 newly authorized Series B preferred shares of NanoSynex, nominal value NIS 0.01 per share, we acquired a majority interest in NanoSynex on May 26, 2022. On April 13, 2021, September 14, 2021 and November 9, 2021, NanoSynex issued unsecured promissory notes to Alpha for an aggregate amount of approximately $905,000, which accrue interest at an annual rate of 2.62% compounded daily (the “NanoSynex Notes”). Since January 1, 2021, the largest aggregate amount of principal outstanding under the NanoSynex Notes was approximately $905,000. The total amount outstanding under the NanoSynex Notes as of March 31, 2023 was approximately $959,000. Since January 1, 2021, no principal or interest has been repaid to Alpha under the NanoSynex Notes.

On December 22, 2022, the Company issued to Alpha, an 8% Senior Convertible Debenture (the “Debenture”) in the aggregate principal amount of $3,300,000 for a purchase price of $3,000,000 pursuant to the terms of a Securities Purchase Agreement, dated December 21, 2022. The Debenture is convertible, at any time, and from time to time, at Alpha’s option, into shares of common stock of the Company, at a price equal to $1.32 per share, subject to adjustment as described in the Debenture and other terms and conditions described in the Debenture, including the Company’s receipt of the necessary stockholder approvals. Between January 9 and 12, 2023, the Company issued 841,726 shares of common stock upon Alpha Capital’s partial conversion of the Debenture at $1.32 per share for a total of $1,111,078 principal. Additionally, on December 22, 2022, the Company issued to Alpha Capital a liability classified warrant to purchase 2,500,000 shares of the Company’s common stock. The exercise price of the warrant is $1.65 (equal to 125% of the conversion price of the Debenture on the closing date). The warrant may be exercised by Alpha, in whole or in part, at any time on or after June 22, 2023 and before June 22, 2028, subject to certain terms conditions described in the warrant, including the Company’s receipt of the necessary stockholder approvals.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of our common stock, to file reports of securities ownership and changes in such ownership with the SEC. Officers, directors, and greater than 10% stockholders also are required by SEC rules to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on the Company’s review of Forms 3, 4 and 5 filed by such persons and information provided by the Company’s directors and officers, the Company believes that during the year ended December 31, 2022, all Section 16(a) filing requirements applicable to such persons were met in a timely manner, except as described below.

Each of Michael Poirier, Amy Broidrick, Christopher Lotz, Shishir Sinha, Wajdi Abdul-Ahad, Tariq Arshad, Richard David, Sidney Emery, Jr., Matthew Korenberg, Kurt Kruger and Ira Ritter filed one late Form 4 report with respect to a grant of stock options that each of them received on July 11, 2022 as follows (all options adjusted for the 1-for-10 reverse split effected by the Company on November 20, 2022): Michael Poirier (37,500 options), Amy Broidrick (13,000 options), Christopher Lotz (10,000 options), Shishir Sinha (10,000 options), Wajdi Abdul-Ahad (8,000 options), Tariq Arshad (10,200 options), Richard David (4,000 options), Sidney Emery, Jr. (4,000 options), Matthew Korenberg (4,000 options), Kurt Kruger (4,000 options) and Ira Ritter (4,000 options).

| -11- |

The following table sets forth information about our current executive officers.

| Name | Age | Position with the Company | ||

| Michael Poirier | 67 | Chairman and Chief Executive Officer | ||

| Amy Broidrick | 65 | President, Chief Strategy and Operating Officer | ||

| Christopher Lotz | 58 | Chief Financial Officer, Vice President of Finance | ||

| Tariq Arshad | 53 | Chief Medical Officer and Senior Vice President |

As noted above, Ms. Broidrick will resign from her current position, effective June 16, 2023.

Officers serve at the discretion of the Board of Directors. There are no family relationships among any of our directors or executive officers. There is no arrangement or understanding between any executive officer and any other person pursuant to which the executive officer was selected.

For the biography of Mr. Poirier, please see the section above titled “The Board of Directors”.

Christopher L. Lotz | Chief Financial Officer, Vice President of Finance. Mr. Lotz joined Qualigen as Director of Finance in 2002 and was promoted to his current role of Chief Financial Officer, Vice President of Finance in 2003. Before joining Qualigen, Mr. Lotz spent the previous 15 years serving in financial leadership positions with Bexcom, an Asian-based software developer, California Furniture Collections, Inc., a custom furniture manufacturer, and Group Publishing, Inc., an educational media publisher. Mr. Lotz holds a B.S. in Business Administration from Colorado State University.

Tariq Arshad, MD, MBA | Chief Medical Officer and Senior Vice President. Dr. Arshad brings more than 20 years of biotech and pharmaceutical experience to Qualigen. He is an oncologist with expertise in both early and late-stage clinical development at several leading and emergent biopharmaceutical companies. Prior to joining Qualigen in May 2021, Dr. Arshad was Global Head of Medical Affairs and Clinical Research with Becton Dickinson Biosciences in San Jose, California from 2019-2021, where he led a team of MDs and PHDs driving scientific strategy for a cutting-edge immuno-oncology focused portfolio. From 2018-2019, Dr. Arshad served as Head of Medical Affairs, Immunology, Global Markets for Sanofi Genyzyme, and Chief Medical Officer, Head of Clinical Research and Medical Affairs for Humanigen, Inc. from 2016-2018. Prior to that, he held leadership positions with XOMA Corporation, Genentech, Inc., Merck & Co., Inc., and Pfizer Inc. Dr. Arshad holds a M.B.B.S (Bachelor of Medicine, Bachelor of Surgery) from University of Punjab, MD from Educational Commission for Foreign Medical Graduates (ECFMG), and a M.B.A. degree from George Washington University.

| -12- |

EXECUTIVE AND DIRECTOR COMPENSATION

Summary Compensation Table (2022 and 2021)

The following table sets forth the compensation paid to or earned by our named executive officers for the periods presented.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Option Awards(1) ($) | All Other Compensation(2) ($) | Total ($) | ||||||||||||||||

| Michael Poirier, Chairman and Chief Executive Officer | 2022 | 575,000 | — | 145,274 | 8,180 | 728,454 | ||||||||||||||||

| 2021 | 517,788 | 218,740 | — | 5,751 | 742,279 | |||||||||||||||||

| Amy Broidrick, President and Chief Strategy Officer | 2022 | 450,000 | — | 50,359 | 7,642 | 508,001 | ||||||||||||||||

| 2021 | 403,077 | 155,000 | 296,170 | 4,055 | 858,302 | |||||||||||||||||

| Tariq Arshad, Chief Medical Officer and Senior Vice President (3) | 2022 | 400,000 | — | 39,512 | 138 | 439,650 | ||||||||||||||||

| 2021 | 253,846 | 80,212 | 430,569 | 69 | 764,696 | |||||||||||||||||

| (1) | The amounts reported in this column reflect the aggregate grant date fair value of the option awards granted during 2022 and 2021, computed in accordance with Financial Accounting Standard Board Accounting Standards Codification Topic 718 for stock-based compensation transactions (“ASC 718”). Such grant date fair values do not take into account any estimated forfeitures related to service-based vesting conditions. Assumptions used in the calculation of these amounts are included in the notes to our consolidated financial statements included in the 2022 Annual Report. These amounts do not reflect the actual economic value that may be realized by the executive officers upon the exercise of the stock options or the sale of the common stock underlying such stock options. |

| (2) | Represents life insurance premiums paid by us for each named executive officer in addition to 401(k) matching contributions paid by us for Mr. Poirier and Ms. Broidrick. |

| (3) | Dr. Arshad joined Qualigen in May 2021. |

Executive Employment Agreements

Employment Agreement with Michael Poirier

Mr. Poirier, is party to an Executive Employment Agreement with Qualigen dated February 1, 2017, as amended January 9, 2018 (the “Poirier Employment Agreement”). The Poirier Employment Agreement had an initial three-year term and is now automatically renewed for successive one-year periods unless either party gives notice of nonrenewal at least 90 days before the end of such a one-year period.

Under the terms of the Poirier Employment Agreement, Mr. Poirier is entitled to an annual base salary of at least $315,000, is eligible to participate in the Company’s bonus plans, benefit programs and medical benefits, is eligible for certain event-based bonuses (including for “Liquidity Event” acquisition transactions), and is entitled to four weeks of vacation per year. If Mr. Poirier’s employment is terminated without Cause or he resigns for Good Reason (as such terms are defined in the Poirier Employment Agreement), and he provides a general release to the Company, he will be entitled to one year of salary continuation plus the cost of COBRA coverage continuation for such one year period. In May 2021, our Board of Directors and the Compensation Committee increased Mr. Poirier’s annual base salary to $575,000. On January 13, 2023, the Company’s Board of Directors, as part of certain cost-cutting measures, approved a temporary 20% reduction to the base salaries of all executive officers of the Company. Accordingly, on January 16, 2023, Mr. Poirier’s base salary was reduced to $460,000.

Employment Agreement with Amy Broidrick

Upon her promotion to the position of President and Chief Strategy Officer in December 2021, Ms. Broidrick is party to an Executive Employment Agreement with Qualigen dated December 10, 2021 (the “Broidrick Employment Agreement”). The Broidrick Employment Agreement had an initial term expiring on April 30, 2022 and is now automatically renewed for successive one-year periods unless either party gives notice of nonrenewal at least 90 days before the end of such a one-year period.

| -13- |

Under the terms of The Broidrick Employment Agreement, Ms. Broidrick is entitled to an annual base salary of at least $450,000, is eligible to participate in the Company’s bonus plans, benefit programs and medical benefits, is eligible for certain event-based bonuses, and is entitled to four weeks of vacation per year. If Ms. Broidrick’s employment is terminated without Cause or she resigns for Good Reason (as such terms are defined in the Broidrick Employment Agreement), and she provides a general release to the Company, she will be entitled to one year of salary continuation plus the cost of COBRA coverage continuation for such one year period. On January 13, 2023, the Board of Directors, as part of certain cost-cutting measures, approved a temporary 20% reduction to the base salaries of all executive officers of the Company. Accordingly, on January 16, 2023, Ms. Broidrick’s base salary was reduced to $360,000.

The following definitions are used in each of the Employment Agreements described above:

“Cause” means any of the following: (i) a material breach by the employee of any of the trade secret/proprietary information, confidential information of intellectual property ownership sections of the Employment Agreement; (ii) a material breach by the employee of any other provision of the Employment Agreement, if such material breach (if susceptible to cure) has continued uncured for a period of at least 15 days following delivery by Qualigen to the employee of written notice of such material breach; (iii) fraud, dishonesty or other breach of trust whereby the employee obtains personal gain or benefit at the expense of or to the detriment of Qualigen or any of Qualigen’s subsidiaries or affiliates; (iv) a conviction of or plea of nolo contendere or similar plea by the employee of any felony; (v) a conviction of or plea of nolo contendere or similar plea by of any other crime involving theft, misappropriation of property, dishonesty or moral turpitude; (vi) a willful and material violation of applicable law by the employee in connection with the performance of his/her duties under the Employment Agreement; (vii) chronic or repeated substance abuse by the employee, or any other use by the employee of alcohol, drugs or illegal substances in such a manner as to interfere with the performance of his/her material duties hereunder; or (viii) failure to comply with the lawful directions of Qualigen’s Board of Directors which are otherwise consistent with the terms of this Agreement, which failure has continued for a period of at least 10 days after delivery by Qualigen to the employee of written demand by Qualigen’s Board of Directors.

“Good Reason” means the occurrence of any of the following circumstances, without the employee’s express consent: the employee resigns due to (i) a material reduction of the employee’s title or authority, (ii) a material reduction in the employee’s salary or benefits (other than a reduction that generally applies to the officers at the employee’s level in Qualigen or, as applicable, after a transaction in which Qualigen or substantially all its assets is acquired, in the successor entity at that time), (iii) any material breach of this Agreement by Qualigen which is not cured within 30 days after written notice by the employee; or (iv) a change of the principal non-temporary location in which the employee is required to perform the employee’s services to any location exceeding 35 miles from Carlsbad, California. In no event shall a resignation be considered to be with Good Reason unless the resignation occurs after but within 30 days after the initiation of the item of Good Reason.

The foregoing description of the employment agreements does not purport to be complete and is qualified in its entirety by reference to the employment agreements.

Offer Letter with Tariq Arshad

Under the terms of his offer letter with the Company, dated May 17, 2021, Dr. Arshad is entitled to an annual base salary of at least $400,000. He received a cash signing bonus of $25,000 when he joined the Company, is eligible to receive annual cash bonuses equal to an amount up to 40% of his annualized base salary, and is entitled to four weeks of vacation per year. Under the terms of his offer letter, if Dr. Arshad’s employment is terminated without Cause or he resigns for Good Reason, and he provides a general release to the Company, he will be entitled to 180 days of salary continuation plus the cost of COBRA coverage continuation for such 180 day period. On January 13, 2023, the Board of Directors, as part of certain cost-cutting measures, approved a temporary 20% reduction to the base salaries of all executive officers of the Company. Accordingly, on January 16, 2023, Mr. Arshad’s annual base salary was reduced to $320,000.

The material terms of our 2020 Stock Equity Incentive Plan (as amended, the “2020 Plan”) are outlined below. This summary is qualified in its entirety by reference to the complete text of the 2020 Plan, which is filed as an exhibit to the Original Report and incorporated herein by reference.

Authorized Shares. We have reserved an aggregate of 755,702 shares of our common stock for issuance under the 2020 Plan. The number of shares is subject to adjustment in the event of any recapitalization, stock split, reclassification, stock dividend or other change in our capitalization. In addition, the following shares of our common stock will be available for grant and issuance under the 2020 Plan:

| ● | shares subject to stock options or stock appreciation rights (“SARs”), granted under the 2020 Plan that cease to be subject to the stock option or SAR for any reason other than exercise of the stock option or SAR; |

| -14- |

| ● | shares subject to awards granted under the 2020 Plan that are subsequently forfeited or repurchased by us at the original issue price; | |

| ● | shares subject to awards granted under the 2020 Plan that otherwise terminate without shares being issued; | |

| ● | shares surrendered, canceled, or exchanged for cash or a different award (or combination thereof); and | |

| ● | shares subject to awards under the 2020 Plan that are used to pay the exercise price of an award or withheld to satisfy the tax withholding obligations related to any award. |

Plan Administration. The 2020 Plan will be administered by our Compensation Committee or by our Board of Directors acting in place of our Compensation Committee. Our Compensation Committee will have the authority to construe and interpret the 2020 Plan, grant awards and make all other determinations necessary or advisable for the administration of the 2020 Plan.

Awards and Eligible Participants. The 2020 Plan authorizes the award of stock options, stock appreciation rights, restricted stock unit, performance awards and stock bonuses. The 2020 Plan provides for the grant of awards to our employees, directors, consultants and independent contractor service providers, subject to certain exceptions. No non-employee director may be granted awards under the 2020 Plan in any calendar year that, taken together with any cash fees paid by us to such non-employee director during such calendar year, exceed $5,000,000 (calculating the value of any award based on the grant date fair value determined in accordance with GAAP). No more than 98,000,000 shares of our common stock will be issued under the 2020 Plan pursuant to the exercise of incentive stock options.

Stock Options. The 2020 Plan permits us to grant incentive stock options and non-qualified stock options. The exercise price of stock options will be determined by our Compensation Committee, and may not be less than 100% of the fair market value of our common stock on the date of grant. Our Compensation Committee has the authority to reprice any outstanding stock option (by reducing the exercise price, or canceling the stock option in exchange for cash or another equity award) under the 2020 Plan without the approval of our stockholders. Stock options may vest based on the passage of time or the achievement of performance conditions in the discretion of our compensation committee. Our Compensation Committee may provide for stock options to be exercised only as they vest or to be immediately exercisable with any shares issued on exercise being subject to our right of repurchase that lapses as the shares vest. The maximum term of stock options granted under the 2020 Plan is 10 years.

Stock Appreciation Rights. SARs provide for a payment to the holder, in cash or shares of our common stock, based upon the difference between the fair market value of our common stock on the date of exercise and the stated exercise price on the date of grant, up to a maximum amount of cash or number of shares. SARs may vest based on the passage of time or the achievement of performance conditions in the discretion of our Compensation Committee. Our Compensation Committee has the authority to reprice any outstanding SAR (by reducing the exercise price, or canceling the SAR in exchange for cash or another equity award) under the 2020 Plan without the approval of our stockholders.

Restricted Stock Awards. A restricted stock award represents the issuance to the holder of shares of our common stock, subject to the forfeiture of those shares in the event of failure to achieve certain performance conditions or termination of employment. The purchase price, if any, for the shares will be determined by our Compensation Committee. Unless otherwise determined by the administrator at the time of award, vesting will cease on the date the holder no longer provides services to us and unvested shares will be forfeited to us or can be repurchased by us.

Restricted Stock Units. Restricted stock units (“RSUs”) represent the right on the part of the holder to receive shares of our common stock at a specified date in the future, subject to forfeiture of that right in the event of failure to achieve certain performance conditions or termination of employment. If a RSU has not been forfeited, then, on the specified date, we will deliver to the holder of the RSU shares of our common stock, cash or a combination of cash and shares of our common stock, as previously determined by the Compensation Committee at the time of the award.

Performance Awards. Performance awards cover a number of shares of our common stock that may be settled upon achievement of performance conditions as provided in the 2020 Plan in cash or by issuance of the underlying common stock. These awards are subject to forfeiture before settlement in the event of failure to achieve certain performance conditions or termination of employment.

Stock Bonuses. Stock bonuses may be granted as additional compensation for past or future service or performance and, therefore, no payment will be required from a participant for any shares awarded under a stock bonus. Unless otherwise determined by our Compensation Committee at the time of award, vesting will cease on the date the holder no longer provides services to us and unvested shares will be forfeited to us.

| -15- |

Change-in-Control. If we are party to a merger or consolidation, sale of all or substantially all our assets or similar change-in-control transaction, outstanding awards, including any vesting provisions, may be assumed or substituted by the successor company. In the alternative, the successor company may issue, in place of outstanding shares held by a 2020 Plan participant, substantially similar shares or other property subject to repurchase obligations no less favorable to the participant. Outstanding awards that are not assumed, substituted or cashed out will accelerate in full and expire immediately before the transaction, and awards will be exercisable for a period of time determined by the administrator.

Amendment; Termination. The 2020 Plan will terminate 10 years from April 8, 2020, unless it is terminated earlier by our Board of Directors. Our Board of Directors may amend, suspend or terminate the 2020 Plan at any time, subject to compliance with applicable law.

Federal Income Tax Summary. The following is a brief summary of the principal federal income tax consequences to us and to an eligible person (who is a citizen or resident of the United States for U.S. federal income tax purposes) (a “Participant”) of awards that may be granted under the 2020 Plan. The summary is not intended to be exhaustive and, among other things, does not describe state, local or foreign tax consequences. The federal income tax consequences of an eligible person’s award under the 2020 Plan are complex, are subject to change and differ from person to person. Each person should consult with his or her own tax adviser as to his or her own particular situation.

This discussion is based on the Code, Treasury Regulations promulgated under the Code, Internal Revenue Service rulings, judicial decisions and administrative rulings as of the date of this proxy statement, all of which are subject to change or differing interpretations, including changes and interpretations with retroactive effect. No assurance can be given that the tax treatment described herein will remain unchanged at the time that awards under the 2020 Plan are made.

A Participant will not recognize income upon the grant of an option or at any time prior to the exercise of the option. At the time the participant exercises a non-qualified option, he or she will recognize compensation taxable as ordinary income in an amount equal to the excess of the fair market value of the common stock on the date the option is exercised over the price paid for the common stock, and we will then be entitled to a corresponding deduction.

A Participant who exercises an incentive stock option will not be taxed at the time he or she exercises his or her options or a portion thereof. Instead, he or she will be taxed at the time he or she sells the common stock purchased pursuant to the option. The Participant will be taxed on the excess of the amount for which he or she sells the stock over the price he or she had paid for the stock. If the Participant does not sell the stock prior to two years from the date of grant of the option and one year from the date the stock is transferred to him or her upon exercise, the gain will be capital gain and we will not get a corresponding deduction. If the Participant sells the stock at a gain prior to that time, the difference between the amount the Participant paid for the stock and the lesser of the fair market value on the date of the exercise or the amount for which the stock is sold, will be taxed as ordinary income and we will be entitled to a corresponding deduction. If the Participant sells the stock for less than the amount he or she paid for the stock prior to the one or two year periods indicated, no amount will be taxed as ordinary income and the loss will be taxed as a capital loss.

A Participant generally will not recognize income upon the grant of a stock appreciation right or a restricted stock unit. At the time a Participant receives shares or cash payment under any such award, he or she generally will recognize compensation taxable as ordinary income in an amount equal to the cash or the fair market value of the common stock received, less any amount paid for the stock, and we will then be entitled to a corresponding deduction. Upon a subsequent sale of the shares received under the stock appreciation right or restricted stock unit, if any, the difference between the amount realized on the sale and the Participant’s tax basis (the amount previously included in income) is generally taxable as a capital gain or loss, which will be short-term or long-term depending on the Participant’s holding time of such shares.

The taxation of restricted stock is dependent on the actions taken by the Participant. Generally, absent an election to be taxed currently under Section 83(b) of the Code, or an 83(b) election, there will be no federal income tax consequences to the Participant upon the grant of a restricted stock award. At the lapse of the restrictions or satisfaction of the conditions on the restricted stock, the Participant will recognize ordinary income equal to the fair market value of our common stock at that time. If the Participant makes an 83(b) election within 30 days of the date of grant, he or she will recognize ordinary income equal to the fair market value of our common stock at the time of grant, determined without regard to the applicable restrictions. If an 83(b) election is made, no additional income will be recognized by the Participant upon the lapse of the restrictions or satisfaction of the conditions on the restricted stock award. We generally should be entitled to a deduction equal to the amount of ordinary income recognized by the Participant, at the same time as the ordinary income is recognized by the Participant. Upon a subsequent sale of the formerly restricted stock, the difference between the amount realized on the sale and the Participant’s tax basis (the amount previously included in income) is generally taxable as a capital gain or loss, which will be short-term or long-term depending on the Participant’s holding time of such shares.

| -16- |

The tax consequences to Participants who receive performance-based awards depend on the particular type of award issued. Our ability to take a deduction for such awards similarly depends on the terms of the awards and the limitations of Section 162(m) of the Code, if applicable. Section 162(m) of the Code currently imposes a $1 million limit on the amount that a public company may deduct for compensation paid to an employee who is chief executive officer, chief financial officer, or another “covered employee” (as defined by Section 162(m)), or was such an employee beginning in any year after 2017. The Compensation Committee retains the discretion to establish the compensation paid or intended to be paid or awarded to the executive officers as the Compensation Committee may determine is in the best interest of us and our stockholders, and without regard to any limitation provided in Section 162(m). This discretion is an important feature of the Compensation Committee’s compensation practices because it provides the Compensation Committee with sufficient flexibility to respond to specific circumstances facing us.

Outstanding Equity Awards at 2022 Fiscal Year-End

The following table presents the outstanding stock options and compensatory warrants held by each of the named executive officers as of December 31, 2022. There were no direct stock awards, restricted stock units or stock appreciation rights outstanding at December 31, 2022. All pre-2020 “option” awards shown were initially issued as Qualigen, Inc. Series C Warrants, and became warrants exercisable instead for our common stock (at an adjusted exercise price) upon the Reverse Recapitalization Transaction. The share numbers and exercise prices in the table below reflect the reverse stock split, which was effected by the Company on November 23, 2022 (the “Reverse Stock Split”).

| Equity Awards | ||||||||||||||||

| Name | Grant Date | Number of Securities Underlying Unexercised Awards (#) Exercisable | Number of Securities Underlying Unexercised Awards (#) Unexercisable | Exercise Price ($) | Expiration Date | |||||||||||

| Michael Poirier | 7/11/2022 | — | 37,500 | (1) | 5.14 | 7/11/2032 | ||||||||||

| 6/5/2020 | 66,667 | 33,333 | (1) | 51.30 | 6/5/2030 | |||||||||||

| 9/22/2016 | 1,443 | — | 25.41 | 9/22/2026 | ||||||||||||

| 3/3/2015 | 2,214 | — | 25.41 | 3/2/2025 | ||||||||||||

| 8/2/2014 | 770 | — | 20.66 | 8/2/2024 | ||||||||||||

| 8/2/2014 | 2,214 | — | 20.66 | 8/2/2024 | ||||||||||||

| 1/31/2014 | 2,214 | — | 20.66 | 1/31/2024 | ||||||||||||

| Amy Broidrick | 7/11/2022 | — | 13,000 | (1) | 5.14 | 7/11/2032 | ||||||||||

| 12/8/2021 | 10,000 | 20,000 | (1) | 12.40 | 12/8/2031 | |||||||||||

| 12/7/2020 | 10,000 | 5,000 | (1) | 35.20 | 12/7/2030 | |||||||||||

| 8/27/2020 | 3,333 | 1,666 | (1) | 47.00 | 8/27/2030 | |||||||||||

| Tariq Arshad | 7/11/2022 | — | 10,200 | (1) | 5.14 | 7/11/2032 | ||||||||||

| 12/8/2021 | 10,000 | 20,000 | (2) | 12.40 | 12/8/2031 | |||||||||||

| 5/17/2021 | 3,333 | 6,666 | (1) | 18.00 | 5/17/2031 | |||||||||||

| (1) | Shares underlying the stock option vest over three years in three equal annual installments from the date of grant. | |

| (2) | Shares underlying the stock option vest over three years in three equal annual installments from the vesting commencement date of May 17, 2021. |

| -17- |

In accordance with the SEC’s disclosure requirements regarding pay versus performance, or PVP, this section presents the SEC-defined “Compensation Actually Paid,” or CAP, of our principal executive officer (“PEO”) and named executive officers for each of the fiscal years ended December 31, 2022 and 2021, and our financial performance. Also as required by the SEC, this section compares CAP to various measures used to gauge performance at the Company for each such fiscal year.

Pay versus Performance Table - Compensation Definitions

Salary, Bonus, Stock Awards, and All Other Compensation are each calculated in the same manner for purposes of both CAP and Summary Compensation Table, or SCT, values. The primary difference between the calculation of CAP and SCT total compensation is the calculation of the value of “Stock Awards,” with the table below describing the differences in how these awards are valued for purposes of SCT total and CAP:

| SCT Total | CAP | |||

| Stock Awards | Grant date fair value of stock awards granted during the year | Fair value of stock awards that are unvested as of the end of the year, or vested during the year |

Pay Versus Performance Table

In accordance with the SEC’s new PVP rules, the following table sets forth information concerning the compensation of our named executive officers for each of the fiscal years ended December 31, 2022 and 2021, and our financial performance for each such fiscal year:

| Year | Summary Compensation Table Total for PEO | Compensation Actually Paid to PEO | Average Summary Compensation Table Total for non-PEO named Executive Officers | Average Compensation Actually Paid to non-PEO Named Executive Officers | Value of Initial Fixed $100 Investment Based On Total Shareholder Return | Net Loss Attributable to Qualigen Therapeutics, Inc. (millions) | ||||||||||||||||||

| 2022 | 728,454 | 262,274 | 473,826 | 121,235 | 4.29 | (18.6 | ) | |||||||||||||||||

| 2021 | 742,279 | (753,431 | ) | 811,499 | 609,691 | 38.21 | (17.9 | ) | ||||||||||||||||

The PEO in 2022 and 2021 is Michael Poirier, our Chairman and Chief Executive Officer. The Non-PEO named executive officers in 2022 and 2021 are Amy Broidrick, our President, Chief Strategy and Operating Officer and Tariq Arshad, our Chief Medical Officer and Senior Vice President. The CAP was calculated beginning with the named executive officers’ SCT total. The following amounts were then deducted from and added to the applicable SCT total compensation:

| SCT Total | Stock awards deducted from SCT | Increase for fair value of awards granted during the year that remain unvested as of year end | Decrease in fair value from prior year-end to current year-end for awards granted in prior years and unvested as of year end | Decrease in fair value from prior year-end to current year vesting date for awards granted in prior years | Total CAP | |||||||||||||||||||

| (A) | (B) | (C ) | (D) | (E ) | A -B+C+D+E | |||||||||||||||||||

| PEO | ||||||||||||||||||||||||

| 2022 | 728,454 | (145,274 | ) | 31,387 | (218,695 | ) | (133,598 | ) | 262,274 | |||||||||||||||

| 2021 | 742,279 | - | - | (1,236,534 | ) | (259,176 | ) | (753,431 | ) | |||||||||||||||

| Average Non-PEO NEO | ||||||||||||||||||||||||

| 2022 | 473,826 | (44,936 | ) | 9,709 | (218,541 | ) | (98,823 | ) | 121,235 | |||||||||||||||

| 2021 | 811,499 | (363,370 | ) | 314,858 | (104,300 | ) | (48,997 | ) | 609,691 | |||||||||||||||

| -18- |

The fair value of stock options reported for CAP purposes in columns (B), (C), (D) and (E) above was estimated using a Black-Scholes option pricing model for the purposes of this PVP calculation in accordance with SEC rules. This model uses both historical data and current market data to estimate the fair value of options and requires several assumptions. The assumptions used in estimating fair value for awards granted during 2022 were as follows: volatility 103%, expected life 5.99 years, expected dividend yield 0%, risk-free rate 3.04%. The assumptions used in estimating fair value for awards granted during 2021 and prior were as follows: volatility 102%, expected life 5.99 years, expected dividend yield 0%, risk-free rate 0.42% - 1.43%.

Analysis of Information Presented in the Pay versus Performance Table

The Company’s executive compensation program reflects a variable pay-for-performance philosophy. While the Company utilizes several performance measures to align executive compensation with Company performance, all of those Company measures are not presented in the PVP table. Moreover, the Company generally seeks to incentivize long-term performance, and therefore does not specifically align the Company’s performance measures with compensation that is actually paid (as computed in accordance with SEC rules) for a particular year. In accordance with SEC rules, the Company is providing the following narrative disclosure regarding the relationships between information presented in the PVP table.

Compensation Actually Paid and Cumulative Total Stockholder Return

During 2021 and 2022, compensation actually paid to our PEO increased from ($753,431) in 2021 to $262,274 in 2022 for Mr. Poirier, and average compensation actually paid to our named executive officers other than our PEO decreased from $609,691 in 2021 to $121,235 in 2022. Over the same period, the value of an investment of $100 in our common stock on the last trading day of 2020 decreased by $61.79 to $38.21 during 2021, and further decreased by $34.12 to $4.09 during 2022, for a total decrease over 2021 and 2022 of $95.91.

Compensation Actually Paid and Net Loss

During 2021 and 2022, compensation actually paid to our PEO increased from ($753,431) in 2021 to $262,274 in 2022 for Mr. Poirier, and average compensation actually paid to our named executive officers other than our PEO decreased from $609,691 in 2021 to $121,235 in 2022. Over the same period, our net loss decreased by $1.6 million during 2021 (from a net loss in 2020 of $19.5 million to a net loss in 2021 of $17.9 million), and increased by $0.7 million during 2022 (from a net loss in 2021 of $17.9 million to a net loss in 2022 of $18.6 million).

Hedging or Offsetting Against Compensatory Securities

We have adopted a policy that our employees (including officers) and directors shall not purchase securities or other financial instruments, or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities granted as compensation to, or held directly or indirectly by, those persons.

| -19- |

For 2022, our non-employee directors received $35,000 in cash for their services. The Audit Committee chair received additional cash compensation of $15,000 and the other Board committee chairs received additional cash compensation of $10,000. Each non-chair member of each Board committee received additional cash compensation of $7,500 (Audit Committee) and $5,000 (other Committees). Non-employee directors each received a grant of 4,000 stock options (adjusted for the Reverse Stock Split) during 2022.

On January 13, 2023, the Board of Directors, as part of certain cost-cutting measures, approved a temporary 20% reduction to the compensation of all directors of the Company effective January 1, 2023.

Compensation paid to Mr. Poirier and to Ms. Broidrick is presented as part of the “Summary Compensation Table” above, rather than here. Our employee directors do not receive compensation for their service as directors.

| Name of Director | Fees Earned and Paid in Cash ($) | Option Awards(1) ($) | All Other Compensation(2) ($) | Total ($) | ||||||||||||

| Richard David | 54,167 | 15,496 | — | 69,663 | ||||||||||||

| Sidney Emery, Jr. | 62,292 | 15,496 | — | 77,788 | ||||||||||||

| Matthew Korenberg | 56,875 | 15,496 | — | 72,371 | ||||||||||||

| Kurt Kruger | 54,167 | 15,496 | — | 69,663 | ||||||||||||

| Ira Ritter | — | 15,496 | 80,000 | 95,496 | ||||||||||||

| (1) | The amounts reported in this column reflects the aggregate grant date fair value of the option awards granted during the year ending December 31, 2022, computed in accordance with ASC 718. Such grant date fair values do not take into account any estimated forfeitures related to service-based vesting conditions. Assumptions used in the calculation of these amounts are included in the notes to our consolidated financial statements included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on May 2, 2023. These amounts do not reflect the actual economic value that may be realized by the directors upon the exercise of the stock options or the sale of the common stock underlying such stock options. |

| (2) | Represents amounts paid for consulting services. |

| -20- |

Equity Compensation Plan Information

The following table presents information regarding securities authorized for issuance under equity compensation plans as of December 31, 2022:

Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by stockholders | 608,012 | $ | 35.02 | 147,690 | ||||||||

| Equity compensation plans not approved by stockholders (1) | 179,046 | $ | 9.12 | — | ||||||||

| Total | 787,058 | $ | 29.13 | 2,809,157 | ||||||||

(1) Consists of shares of common stock issuable upon the exercise of compensatory warrants granted to service providers.

| -21- |

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTTHE COMPANY

Security Ownership Of Certain Beneficial Owners And Management

The following table sets forth certain information regarding the beneficial ownership of our common stock as of November 22, 2017May 15, 2023 by:

| ● | our named executive officers; | |

| ● | ||

| ● | all of our current directors and executive officers as a group; and | |

| ● | each stockholder known by us to own beneficially more than |

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”)SEC and includes voting or investment power with respect to the securities. Shares of common stock that may be acquired by an individual or group within 60 days of November 22, 2017,after May 15, 2023, pursuant to the exercise of options or warrants, are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. The percentage of beneficial ownership of our common stock is calculated based on an aggregate of 49,506,5215,052,463 shares outstanding as of November 22, 2017.May 15, 2023.

Except as indicated in the footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them, based on information provided to us by such stockholders. Unless otherwise indicated, the address for each director and executive officer listed is: c/o Ritter Pharmaceuticals,Qualigen Therapeutics, Inc., 1880 Century Park East, #1000, Los Angeles,2042 Corte Del Nogal, Carlsbad, California 90067.92011 USA.

| Beneficial Owner | Number of Shares Beneficially Owned | Percentage of Common Stock Beneficially Owned | ||||||

| Five Percent Stockholders | ||||||||

| Javelin Entities(1) | 7,776,534 | 15.6 | % | |||||

| Aleyska Investment Group L.P.(2) | 4,902,285 | 9.9 | % | |||||

| Sabby Volatility Warrant Master Fund(3) | 4,900,000 | 9.9 | % | |||||

| Aspire Capital Fund LLC(4) | 4,900,000 | 9.9 | % | |||||